Guide to Construction Equipment Rental Insurance

Construction companies need to protect their equipment. Whether you rent or own your construction equipment and machinery, insurance can help mitigate costs and decrease legal liability on job sites for better financial security and increased trust with partners. While renting offers many benefits to construction companies, you can help keep your business's assets safe with construction equipment rental insurance.

Jump to a section:

What Is Construction Equipment Rental Insurance?

Construction equipment rental insurance is a protection policy that covers the cost of damages and replacements required for rentals. Renting can offer construction companies many benefits, like access to newer models and increased functionality, but the risk of damages from sites leaves teams financially vulnerable. This insurance policy type helps decrease financial liability in the event of certain accidents or theft, allowing companies to only pay their determined deductible.

This insurance is often very flexible. When searching policies, you can find temporary, short-term options or permanent coverage. Varying lengths can help match your company's rental history and frequency, ensuring you always have protection throughout your entire project timeline.

Who Provides Construction Equipment Rental Insurance?

Construction companies interested in equipment rental insurance can purchase it from different providers depending on their needs. Many property insurance providers offer equipment rental insurance plans to add to existing plans, allowing companies with this policy to increase their coverage easily. Investing in construction equipment rental insurance with your current provider can simplify policy management and payments. When you need to look up information regarding your coverage or deductibles, you'll know where to look.

For companies without property insurance or looking for a more short-term rental plan, most rental organizations offer equipment rental insurance policies with their rental agreements. This offer will last the entirety of your rental period, ensuring complete coverage over projects. It is also great for companies who rent more infrequently but still want financial and liability protection when they do.

What Does Construction Equipment Rental Insurance Include?

Equipment rental insurance covers many costs and situations. Most equipment rental insurance policies cover the following:

- Accident protection

- Repairs and parts replacements

- Theft and loss

- Site and other equipment damages

Equipment rental insurance aims to provide comprehensive financial and asset protection. When accidents with rental equipment damage or harm your facilities or other machinery, your policy can help you cover repair costs. Because each provider and plan offers unique protection, reading through coverage can ensure you get the level of protection you need.

While each provider covers different situations, they omit similar factors from coverage. You can expect equipment rental insurance not to cover costs related to accidents caused by equipment misuse or abuse. For example, equipment damage from overloading past the model's limits can qualify as misuse, leaving companies liable for covering costs for repairs and part replacements. Failing to store or protect equipment during the rental period can qualify as abuse, making renters responsible for related damage and theft.

How Much Is Construction Equipment Rental Insurance?

Construction equipment rental costs will vary depending on the provider and the included coverage. Many rental companies calculate their rental deductibles based on the equipment's value, the equipment's age and the type of construction work. Companies and providers have various limits, so exploring different options can help you find the choice that matches your construction budget.

Construction Equipment Rental Insurance vs. General Liability Insurance

Construction teams have many options when choosing protection plans, including general liability insurance. Understanding the difference can help your construction business find the option that can offer the best protection for your needs.

A general liability insurance plan will cover the costs of damages and repairs caused by rented and owned equipment. This insurance policy is essential for protecting your properties, assets and finances when working on projects. However, general liability insurance will not include damages to your equipment or necessary repairs in the event of an accident.

When you want comprehensive protection that covers your property and equipment, you might consider investing in general liability and construction rental equipment insurance policies.

Construction Equipment Rental Insurance vs. Damage Waivers

Damage waivers are another option to protect your finances, but they differ from construction equipment rental insurance policies. Like many rental insurance plans, construction equipment rental companies will offer these waivers with rental contracts as a protection method. A damage waiver will set a determined amount or percentage in the event of equipment damage or theft, limiting how much money you are financially liable for.

Most rental companies will provide different damage waiver limits depending on the equipment you rent. They might take a percentage of the total equipment worth to help them cover repairs and replacements while reducing your financial burden. However, you should expect a higher damage waiver limit if renting more expensive equipment.

A damage waiver can be an excellent option for companies with a limited budget, but construction equipment rental insurance offers more comprehensive financial protection, and insurance coverage will typically come from the provider rather than your company.

Rental Equipment Protection

When renting from The Cat® Rental Store, dealers offer Rental Equipment Protection (REP). REP lasts throughout your rental timeline, and it's separate from your equipment coverage. This straightforward, all-risk policy means loss or damage is covered, unless it's listed as excluded.

What Does Rental Equipment Protection Include?

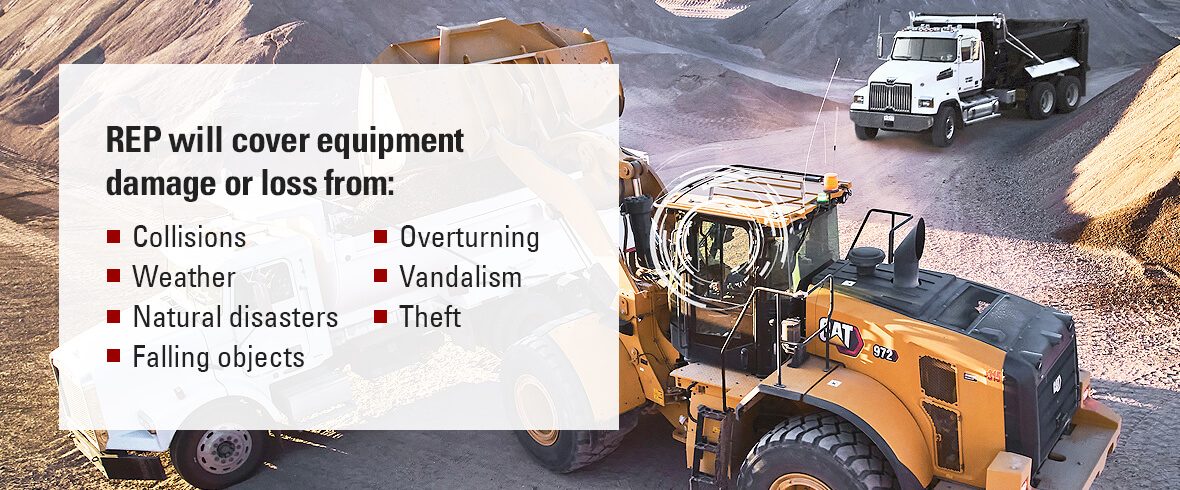

When you choose REP with your local Cat dealer, you'll receive extensive coverage that protects your business from various scenarios. REP will cover equipment damage or loss from:

- Collisions: Construction sites often have many pieces of equipment in operation. As power machines, equipment collisions can cause extensive damage to rentals. REP helps cover the cost of dents, scratches and replacements.

- Weather: The weather can turn quickly in many locations, and you'll likely be working with equipment outside often. Having a comprehensive construction equipment rental insurance like REP can cover damage from hail or objects moved by high winds.

- Natural disasters: When natural disasters can wreak havoc, your construction rentals might get caught in the wreckage. Whether you are facing earthquakes, floods, fires or tornados, REP can protect your finances and rental equipment from minor and extensive damage. REP also covers instances where natural disasters cause equipment to get lost in the debris. If you live in an area with unpredictable weather patterns or an increased risk of natural disasters, this kind of protection can be essential for your business.

- Falling objects: From falling branches to scaffolding and equipment, risks are high on construction sites. REP protects your rentals when falling objects might cause damages for coverage that meets your industry's unique needs.

- Overturning: Uneven ground or loads can cause equipment to tip or overturn, leading to dents, scratches and other damage. Each construction site comes with different terrains and unknown hazards, making it challenging to plan for potential risks. REP can ensure you have protection at every location and project.

- Vandalism: REP covers repairs caused by vandals marking your rented equipment. From spray paint to scratches, this protection plan will help rental companies maintain their equipment quality without draining your finances.

- Theft: When theft leaves you without equipment to return to your rental company, REP can prevent you from paying for a full replacement.

With REP, you'll receive comprehensive coverage over multiple situations. Your business can better protect itself from unforeseeable issues, so you can continue offering your clients the best construction services.

What Does Rental Equipment Protection Exclude?

REP can protect your construction company from many threats. In some situations, your company might be liable and have to cover the costs of damages and equipment loss. Some exclusions under REP can include:

- Seizures by authority: If legal authorities, like police or city planners, impound equipment, construction companies will be responsible for damages or losses.

- Equipment misuse and abuse: Equipment quality depends on operators following their specifications. Using incorrect liquids, carrying loads or applications can lead to functional damages that require repairs. These uses might violate rental contracts, making companies liable.

- Mechanical and electrical breakdowns: Internal functions, like electrical wiring, are not included under REP. Other mechanical damages that fall under this category include broken glass, damaged tracks or flat tires.

- Transit damages: Construction companies are responsible for any damages or losses that occur while equipment is in transit. Construction companies will not have coverage under REP when moving rented equipment to and from job sites or storage facilities.

- Corrosion and decay: Rust, fungus, mold and mildew buildup on equipment often signifies poor storage and use. Construction companies will be responsible for any deterioration and decay that occurs during the rental period.

Understanding what REP includes and excludes can allow construction companies to identify what kind of protection they need and whether this option is right for them.

How Much Are Rental Equipment Protection Deductibles?

When you sign up for REP, you will pay a deductible for any covered repairs and replacements. Your Cat dealer will determine your REP deductible based on your rental's value.

Certificate of Insurance

A Certificate of Insurance (COI) proves that someone holds an insurance policy. Insurance providers will issue COIs to policyholders, outlining essential information about your insurance coverage. In construction and equipment rentals, COIs can ensure your rental dealer that you have protection from common risks and won't be a liability. Some dealers might require a COI before renting if you don't want to purchase their provided equipment rental insurance or add-ons.

COIs might also be called a certificate of liability or proof of insurance.

What Does a Certificate of Insurance Include?

A COI will include several pieces of information to provide to partners, like your rental dealers. Some data your insurance provider will list on a COI include:

- Policyholder or business name

- Policy and coverage type

- Coverage period

- Other protected businesses and assets under that policy

- Contact information for the insurance provider

Whether you are receiving your COI or checking a potential business partner's, knowing what should be on a COI can ensure it is valid and legitimate. Insurance providers should always issue COIs that serve as authentic proof of insurance.

Why Is a Certificate of Insurance Important?

COIs are crucial documents for construction businesses. They help you build trust with others in your industry. Some benefits and purposes of obtaining a COI include:

- Protecting partnerships: A COI shows you have insurance that makes you less of a liability to your business partners. When you have insurance to cover the costs of accidents, your partners will have more confidence that you will be able to obtain your end of the contract. Rental companies ask for some kind of rental insurance to maintain their business and yours. You should also ask for relevant COIs from your subcontractors, clients and other partners.

- Increasing financial protection: Checking that your partners have insurance can protect your finances in addition to having your own insurance policies. For example, if a subtractor causes damage on your job site and doesn't have insurance, you might be responsible for covering it. These situations and having comprehensive coverage can protect your company's finances throughout every stage of your project.

- Meeting bid requirements: When construction teams rely on submitting bids to get projects, you'll need to have everything prepared to secure the jobs you want. Many requests will ask you to submit some proof of insurance, so having a COI can ensure you have the correct documents. The COI will communicate to clients that you will not be a liability if something goes wrong on their property.

COIs protect your construction business on several sides. Whether you are trying to secure bids or reduce financial liability, a COI can offer some assurance in this industry. When renting construction equipment, a COI can allow you to work with dealers.

How to Obtain a Certificate of Insurance

When you need a COI, you can request one by contacting your insurance provider. Your provider will send you a version that complies with their policy and state legislation. After receiving your COI, you should check that all information is correct and nothing is missing.

Get Protection for Rental Equipment With The Cat® Rental Store

Insurance for rental equipment can protect your business from the costs of repairs and replacements when the unexpected occurs on job sites. While you can add a renter insurance policy through another plan, using REP from your local Cat dealer can offer you comprehensive coverage and meet your needs. REP can function as a stand-alone coverage option or additional protection to existing plans.

The Cat Rental Store has locations worldwide, so you can rent your construction equipment from a dealer close to home. Local dealers make transporting and storing your construction rentals easy, and they'll understand your location's unique needs and requirements for better care. The Cat Rental Store dealers offer a wide selection of construction equipment and attachment rentals for increased functionality.

Find a Cat dealer near you today for quality rental equipment to boost your job site operations.

Find The Cat Rental Store Near You